CSPs have the opportunity to capture a sizable slice of a $130bn+ incremental revenue opportunity (as estimated by Appledore Research) in the growing markets of dynamic enterprise services, IoT, 4IR and private networking. Success will demand a new management layer that supports automation, agility, and therefore cost effective innovation, often by 3rd parties, and also often by exposing APIs and NaaS. Referred to in various ways – as “end-to-end”, or “cross-domain” service orchestration, it requires distinct new capabilities in addition to those already in play within lower-level technology domains.

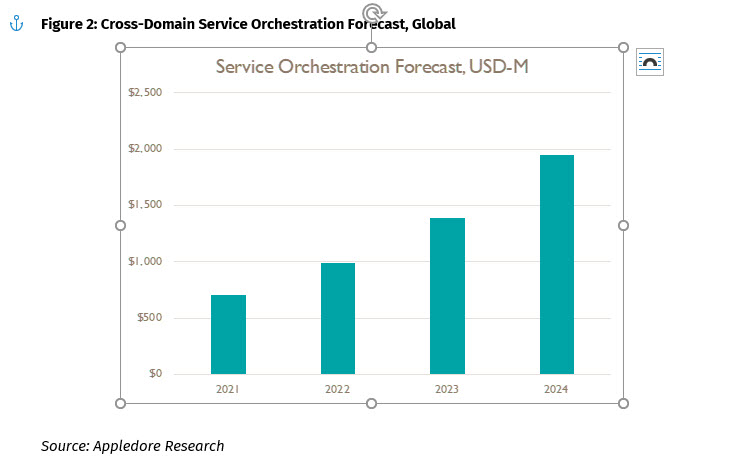

The market for this form of orchestration is both growing and evolving rapidly. Vendors have invested and innovated significantly over the last two years to address the new requirements, and CSPs have increasingly realized that automation is a business requirement, not a technical feature. We estimate this market will grow from $509m in 2021 to $1.9bn in 2024.

The essential technical concepts required for successful implementations are agreed on, well understood and largely incorporated by vendors in this market. Yet CSP needs vary widely, according to size and their own commercial priorities, strategies, and previous technical choices. CSP success will also depend on organizational shifts in mindset and practices.

Cross-domain (and in fact, cross-company/collaboration), automated orchestration is essential to new revenues, and to the needs of modern enterprises. Moreover, it is critical to new sets of B2C and public good services (e.g.: smart city) in the growing IoT segment. Appledore has estimated that the entirely new incremental revenues that may be gained, and that demand highly agile and automated orchestration, is over USD 130B. Traditional orchestration (really workflow) is ill-suited to this task.

Adoption of end-to-end automation, within domains and then across domains, continues to be gradual, lagging the capabilities of vendors in the market. Nonetheless, we expect that commercial pressures on CSPs will make adoption of greater automation irresistible.

It’s not just about just the telco anymore…

It is now imperative to think of orchestration in terms of interconnected clouds. The entire end-to-end telco is one cloud, and it operates in an environment of other clouds (e.g.: public cloud providers). In this context we include SDN, SDWAN, dynamically configurable 5G all cloudified assets, in addition to traditional datacenter workloads (VNF/CNFs).

The objective as we move to cloud must not be “virtualization”, but rather flexibility, self-management and therefore automation.

In this major new 60-page report, the result of extensive, in-depth conversations, we assess the state of the market and the most notable players within it. Vendors profiled include: Amdocs, Blue Planet, Cisco, Comarch, Ericsson, HPE, IBM, Inmanta, Itential, Juniper, Netcracker, Nokia, Oracle, Rakuten Symphony, VMware.

This is a diverse market with many opportunities not only for vendors, but also for CSPs to make the step change into a new mode of automated, dynamic, agile – and hard to predict – services. With USD 130B in new revenue available, there is much opportunity at stake.

To see the full table of contents, download a 15-page extract of key findings (free), or to order the full report, click here.

Image credit: Spencer Imbrock on Unsplash