Warm words, MoUs and webinars aplenty – but who’s actually winning in Open RAN?

Open RAN was originally conceived of as a way to free CSPs from restrictive roadmaps and slow delivery timescales. It wasn’t that CSPs had a beef with any particular major vendor, just that they were all too darned SLOW. If major equipment vendors would give CSPs what they wanted, fine. But if CSP buyers needed to turn to new suppliers to get what they needed, then so be it.

And so Open RAN has picked up considerable momentum in the last 12 months, with its appeal spreading within and beyond the original founders of the O-RAN Alliance.

But do all those webinars, airtime and column inches translate into a change in the market?

We’ve said before that Open RAN is a movement not a standard – by which we mean that its goals are more commercial, than only technical. The success of Open RAN is ultimately judged not by the existence of new (or changed) offerings, but by CSPs actually buying them.

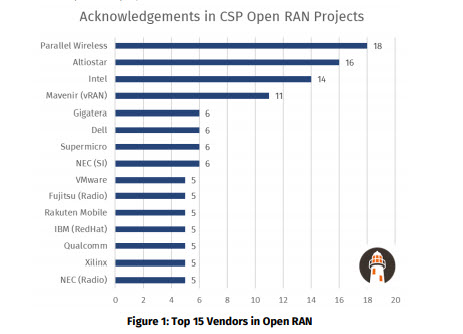

With that in mind, our latest report set out to ask a simple question: who’s winning in Open RAN? Who are the vendors who seem to be gaining traction with the CSPs actually driving Open RAN projects?

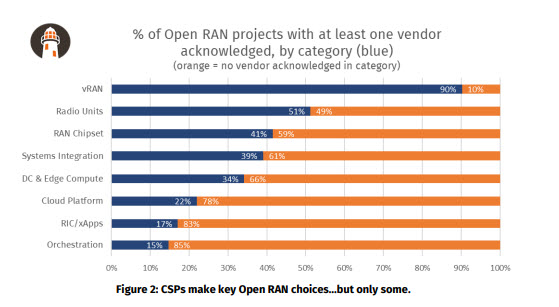

One inadvertent consequence of Open RAN is to afford greater insight into the decisions on the piece parts and individual capabilities that go into building a RAN. We looked at around 180 actual (or strongly indicative) preferences made by CSPs in relation to Open RAN projects, 40+ projects and across some 30+ vendors, in eight categories.

As a by-product, we gained a view of how far along individual CSPs are in making the key decisions that are necessary part of making Open RAN a reality. That makes interesting reading. Despite there being some 40+ “open RAN” projects known, most projects have yet to declare a visible preference in most of the key categories.

So – plenty of whitespace out there in Open RAN, which is hardly a surprise: this is an early stage market. But there is certainly an advantage for vendors to being seen at the front of the pack, even at this stage.

So who’s winning? Well, here’s what we found.

For Open RAN fans, perhaps not that many surprises here – but take “open” out of the chart’s title, and imagine this as “Top vendors in RAN”, which it could well be in 5 years’ time. Wouldn’t that be interesting?

Despite the clear impact that challenger vendors are making, the evidence bodes well for telecom CSPs – it looks like the industry is stepping up to the calls for greater openness, speed and diversity. And this is just the beginning. The major investments and support being given by large vendors to Open RAN explicitly (Dell’s is the just the latest example), will take time to have impact – but impact they will surely have.

We understand that many significant participants in Open RAN (both CSPs and vendors) can’t yet share details and plans, or express vendor preferences as publicly as others. But some of their peers (thank you, Telefonica, Vodafone…) are leading from the front and showing that for Open RAN to be successful, it has to be supported not just with lab work and trials, but with PR and analyst briefings, even on the work-in-progress.

The free-to-download version of the report runs to 15 pages, the full version adds more findings, breakdowns, details, profiles and commentary on notable vendors and CSPs (in an Open RAN specific context). Both are here.

Picture credit: Steven Lelham (@slelham) | Unsplash Photo Community