SONIC’s program is ambitious but pragmatic, and is well aware of the wider challenges to Open RAN adoption.

One of the sidebar discussions in Open RAN has been what the role of governments can or should be in driving its adoption. Some in the industry are concerned about government-sponsored market distortion, with the government essentially “picking winners” outside of conventional market forces. Others take the view that the market has already been distorted by geo-political and (or) overriding security concerns, and so government support is a necessary follow-through.

So it was interesting to see policy and practicalities brought together in the recent update presentation from “SONIC” – a UK government-backed initiative to establish a “commercially neutral, sustainable, permanent and evolving UK national capability program” working in support of Open RAN. And in turn, working in support of UK government goals to diversify the telecom vendor supply chain, accelerate 5G, and boost enterprise productivity.

About SONIC

SONIC stands for “SmartRAN Open Network Interoperability Center”, and was announced in Nov 2020 by the UK Department for Culture, Media and Sport (DCMS).

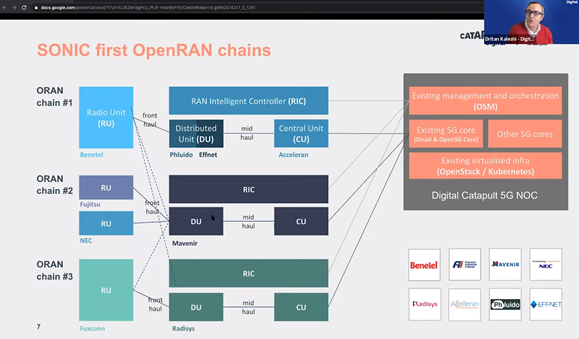

As with much else in Open RAN, SONIC is moving quickly. By the end of May 2021, it will have established three distinct, “representative networks” for 5G Open RAN, involving multiple vendors.

SONIC has thought through its aims with clarity and pragmatism. It understands that government policy does not exist in a vacuum, but in the context of an actual supply chain. And that the government can support efforts to be more open without necessarily “picking winners”. Thus, SONIC aims to do three things:

- Foster the idea of an ecosystem of vendors, co-creating and collaborating – that is, ecosystem engagement.

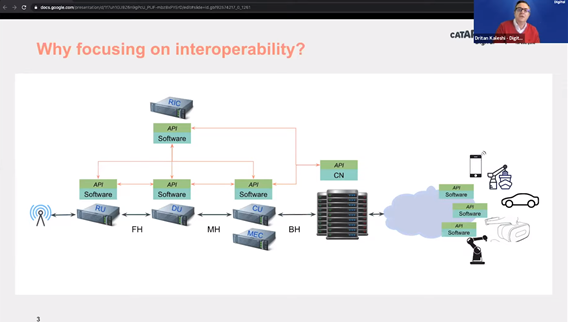

- Foster the technical engagement – specifically, interoperability between open components, in a commercially neutral context.

- Provide the facilities for representative real-world proving and analysis of open RAN.

Interoperability testing is the initial focus since this is the most fundamental proof point for OpenRAN.

SONIC sees its position in the innovation lifecycle as beyond core R&D stage but prior to working with finished products. Its purpose is not to certify or validate vendor products, but to enable vendors to learn from efforts to make their Open RAN components interoperable. Specifically, by being able to do that in the context of realistic environments. As Dritan Kaleshi put it, “peer-assist not peer-assess”.

SONIC already has a common infrastructure: an SDN-enabled, fully virtualised compute with high–capacity interconnect. This is being overlaid with a test & measurement platform. The goal is to have a network within which various DU and CU can be installed and analysed against other combinations and in a range of real-world indoor, outdoor and urban scenarios.

Three Chains, Eight Vendors

Eight vendors are already collaborating under SONIC’s aegis, to construct three flavours of Open RAN: Radio Units (RU) from a mix of Benetel, Fujitsu, NEC and Foxconn; Distributed Units (DU) from Radisys and Mavenir, plus Phludio and Effnet, with Accelleran providing the Centralised Unit (CU) and overall Systems Integration.

While Open RAN is expected to drive innovation, not every vendor in Open RAN will be a startup. Mavenir has been around since 2005, Accelleran since 2013. And Open RAN may breathe new life into (or at least, a new route to market) for long-established small cell vendors. As panelists pointed out, Open RAN is drawing on a considerable pool of existing technical expertise and experience.

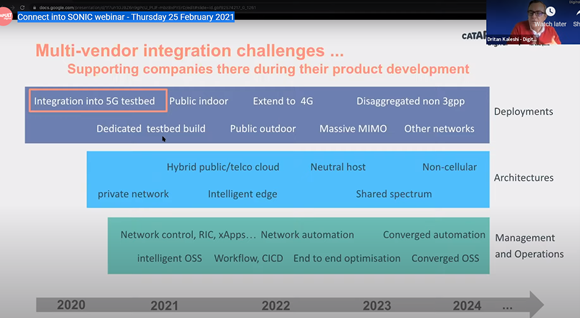

For SONIC, Open RAN is just the beginning. There is a long roadmap of multi-vendor applications to be facilitated.

Cautiously Optimistic

A pre-event poll from registrants (across government, vendors, SIs, hosts, operators and academic researchers) revealed that 75% thought the UK would see “wide scale deployment” of a mature Open RAN within 3-5 years. On which market areas would see the most impact, registrants were roughly equally split, across in-building, macro, neutral host, private networks, shared mobile access and small cell networks – indicating that there is not one standout industry use case or sector that drives or owns Open RAN adoption.

Of course, one would expect positive vibes from panellists in a presentation like this. However, the optimism came with a recognition of the challenges: in particular, that operators themselves are the real key. Despite being generally behind open initiatives, the question remains whether UK operators will be ready and willing to make the changes are a prerequisite for reaping the benefits of Open RAN:

- a software-defined, more dynamic (and to some degree, more autonomous) RAN.

- the need to manage multiple vendor relationships – with all the practicalities for product development, procurement, legal and risk management that will involve.

- the ability to incorporate innovations at a much faster rate not only in the network, but across sales, marketing, and customer support functions.

- the ability to work in partnership with multiple others as part of an overall ecosystem rather than the traditional model in which the operator tries to own (or to outsource) the whole problem.

SONIC is a welcome addition to (and well aligned with) the array of industry initiatives to progress Open RAN – all the more so as it is concerned not only with technical interoperability, but also with how Open RAN vendor ecosystems themselves can be made viable, irrespective of specific participants.

Among UK operators, the wheels of Open RAN are already moving, albeit at varying rates. However, the session also hinted at potential direct for enterprises (i.e. operator-less) with Open RAN-based 5G private networks (see this Cellnex announcement). “UK telecom” need not mean UK operators alone….

I look forward to tracking SONIC’s progress with interest.

Connect into SONIC webinar – Thursday 25 February 2021 – YouTube

For further analysis of Open RAN and how it is reshaping the telecom market see Appledore Research on Open RAN.