Our major new market share report ranks leading vendors of telecom network automation software, and reports on changes in the nature of spending from operators.

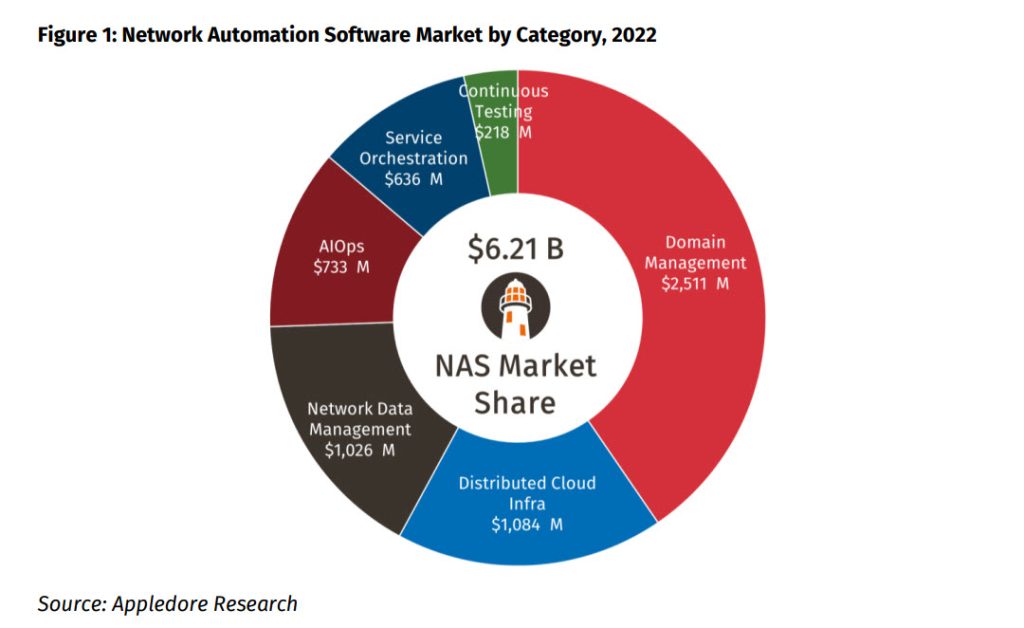

In 2022, CSPs spent US$6.21B on software to automate their networks. This represents a CAGR of 20% since 2020 – a sizeable rate of growth, given the prevailing condition of telecom as a whole.

In the last two years, telecom has continued to be affected by seismic forces and uncomfortable truths. The ending of the pandemic is only the start of a new kind of normal. Climate change and war in Ukraine have exacerbated concerns about energy costs. The march of hyperscale companies continues apace. Five years of hype in 5G is is coming home to roost. It is against this backdrop that telecom operators have been making their decisions about what, how and with whom to spend on network automation software.

Software has historically been the “poor relation” to hardware spend in the telecom industry. Yet increasingly it is software that will be fundamental to the priorities of fixed and mobile telcos: agility, growth, innovation, profitability, security – all linked by the pursuit of automation.

We see positive signs from our hundreds of hours of discussions, briefings and meetings through the year. Over the last few years, vendors large and small, both from within telecom sector and from outside it, have all been investing to create what amounts to the launch platform for telecom to reach for the stars. We are not there yet, and there remain considerable headwinds, but on the basis of our analysis, “we have liftoff!”

This new analysis of the telecom network automation software (NAS) market provides market sizing and vendor market share estimates across multiple segments including:

- Artificial Intelligence Operations (“AIOps”) – the applications that use network (and other) data to drive decisions and processes.

- Cross-Domain Service Orchestration – end-to-end control of network services and functions.

- Domain Management – largely, the classical “network-facing” functions.

- Distributed Cloud Infrastructure Management – software used to automate and optimize network inventory, place workloads.

- Observability & Network Data Management – collection, storage, presentation of network data of all kinds.

- Continuous Testing (formerly Component Lifecycle Management) – software for automation of test, validation of (software-ized) network functions.

As we stand on the brink of perhaps the most profoundly transformative change agent yet – AI – this report provides an insight into the readiness of telecom operators for new growth, predicated by fundamental change and enabled through software.

Vendors referenced include: Amdocs, AWS, Ciena, Cisco, Ericsson, Huawei, HPE, IBM Red Hat, Juniper, Keysight, Microsoft Azure, Netcracker, Netscout, Nokia, Oracle, Rakuten Symphony, Spirent, Splunk and VMware.

The full report runs to over 35 pages, a free sample download is available. For more information see here.