The subtitle for the DSP Leaders World Forum was Accelerating Telecoms Innovation, yet the topic of innovation yielded the least convincing answers of the two-day event.

It was co-host Guy Daniels who brought up the rise of “FAST” – Free, Ad-Supported Television channels – a $6bn industry now made possible by the combination of broadband, cloud and massive-scale personalization. Another ship that telecom looks set to watch sail away over the horizon. It was about the most innovative thing mentioned.

TelecomTV was also innovating with a revised format that gave CSPs – sorry: DSPs – a co-host role on panels, and a 5-minute opening micro-keynote. This gave senior telco execs from Vodafone, Telefonica, Deutsche Telekom, BT and Orange a chance to frame the discussion of each panel.

Mood music was similar to Futurenet World and RCR Wireless’ Telco Reinvention: an industry still trying to map out its future role, and still grappling with the enormity of the change – but also opportunities – resulting from technologies such as cloud and AI.

The good news is that the case for fundamental change is being added to day-by-day, and telcos know it. The bad news is that that such change remains immensely difficult in an industry that is so proud of what it has achieved over its long history. Nonetheless, most if not all of the enabling components are already available to use. Today’s telcos have never had a better opportunity to set ambitious new goals with a decent chance of achieving them, to become true DSP Leaders.

We offer our takeaways from this perfectly-produced event.

Telco to Techco

Vodafone Group CTO Scott Petty acknowledged the underperformance of telecom, and the cultural shift that Vodafone has been making for the last few years: swinging the needle back from “outsource” to “insource”; adding significant software engineering resources; from waterfall development to CI/CD; from a cadre of professional vendor managers and procurement specialists to a sleeves-rolled-up systems integrator.

Petty says the effect of Vodafone’s changes are most visible in the increased velocity of software development, with updates to its BSS now on a three-weekly cycle, rather than quarterly, for example.

Cormac Whelan summarized the cultural gulf that Dell faces as he attempts to take the new reality of cloud-based, open, disaggregated, dynamic, intelligent architecture to telecom execs: “Dell? Telco? Really?”

Kristian Toivo from TIP (admittedly, a church for the converted), sees growing evidence of telcos “getting their hands dirty” on transforming their ways of working.

Appledore’s takeaway on this particular “telco to techco” discussion: if it doesn’t feel deeply uncomfortable, you’re not doing it right.

Skills Attraction, Retention

Attracting and retaining talent is widely regarded as a major challenge, with the same skill sets in high demand across many industries. Graduates securing a job in telco today are regarded by their peers as having won something of a consolation prize.

Weaver Labs co-founder Maria Lema counselled telcos to work more imaginatively in their recruitment drives (Hint: the people you need aren’t hanging out on LinkedIn.)

Operations and Efficiency

Three UK may have the lowest capex of the major UK operators, but leveraging the TM Forum’s work, is making progress in automation. Bringing data together means better co-ordination between sales and marketing and network engineering, to reduce the “dead air” of idle infrastructure.

Mark Gilmour of pan-European transport provider Connectivitree also highlighted how automation was fundamental to a modern telecom business model. Ken Rayer from BAI explained how the neutral host model had evolved quickly from primarily civils-centric to one based on intelligence and automation.

Wind River’s Warren Bayek highlighted the link between disaggregation (as an architectural decision) and automation (as a business priority), rightly widening the scope of automation beyond operations to areas such as vendor onboarding, validation and test.

Everyone was in favour of equipping engineers to create automation by themselves. According to Ken Ranger at BAI, that can even turn into a business opportunity. Telcos may be blind to the opportunity cost of not automating.

The goals of an automation strategy can be easy to frame: “where will automating what you do help customers do better what they do?” And good-old time-to-deliver remains an easy top of that list.

“Concrete examples” (not)

IBM’s Andrew Coward (a recent guest on the Appledore podcast) offered the best analogy of the event: “Automation is like pouring concrete”, cautioning against the sort of automation that bakes-in today’s processes and ways of working. Wind River’s prescription is for declarative and outcome-based approach to automation. (The event’s second-best analogy was Three UK’s comment that “energy-saving solutions are the modern day snakeoil”.)

Nastasi Karaiskos from Rakuten Symphony emphasized the importance of a common, telco-specific platform in enabling a business-wide telecom automation strategy.

Takeaway: Automation will (should) save opex, but it’s becoming a much more fundamental part of service introduction, rollout and delivery.

Open APIs

Juan Carlos Garcia, Telefonica SVP of Technology and Ecosystems was co-host for a panel on APIs. He acknowledged that earlier efforts to offer third parties access to telco networks had failed because of rigidity. But in the world of cloud, open interfaces with multi-operator support, there is a much greater chance of success. The CAMARA/Open Gateway represents the industry’s best attempt, with commercial network APIs promised in 2023.

There’s now no excuse for telecom not to understand that developers ARE the customer for network APIs, with co-founders like Microsoft Azure for Operators, AWS and the Linux Foundation behind Open Gateway. If abstraction means anything, it means that companies like Weaver Labs could emerge as kingmakers in telecom.

Appledore’s takeaway is that the CSPs have a significant leap to make in culture before they can truly become software-driven DSPs. CSPs, with their vendor’s support, need to be a lot more ambitious about trialling APIs with developer customers: see what works, see what doesn’t. Otherwise, the likely destination, even with new open, agile software practices is likely to be the same as previous telco APIs.

Innovative vs Energy optimization

BT Group Chief Security and Network Officer, Howard Watson, trumped the “innovation vs energy efficiency” conundrum with the “overprovisioning paradox”: in an effort to stay ahead of demand, more network is deployed than is necessary. But provisioning just enough capacity would mean not taking advantages of jumps in technology.

Vodafone’s Francesca Serravalle sees the move to containerized applications as an innovation that directly supports greater energy efficiency. Likewise, Dell’s Manish Singh sees disaggregation as opening more opportunities to optimize energy use.

Discussion about service innovation itself was somewhat arid. Disaggregation and transformation are all very well, but specifics on what sort of experiences and services these will enable for customers remain thin on the ground. At least Watson was honest about telcos’ cultural difficulty with embracing innovation and change – even when the benefits appear obvious (SRv6 and dense ethernet were referenced in discussion).

Takeaway: Newer is better – but don’t overlook the need for a plan to switch off the old and migrate customers over.

AI

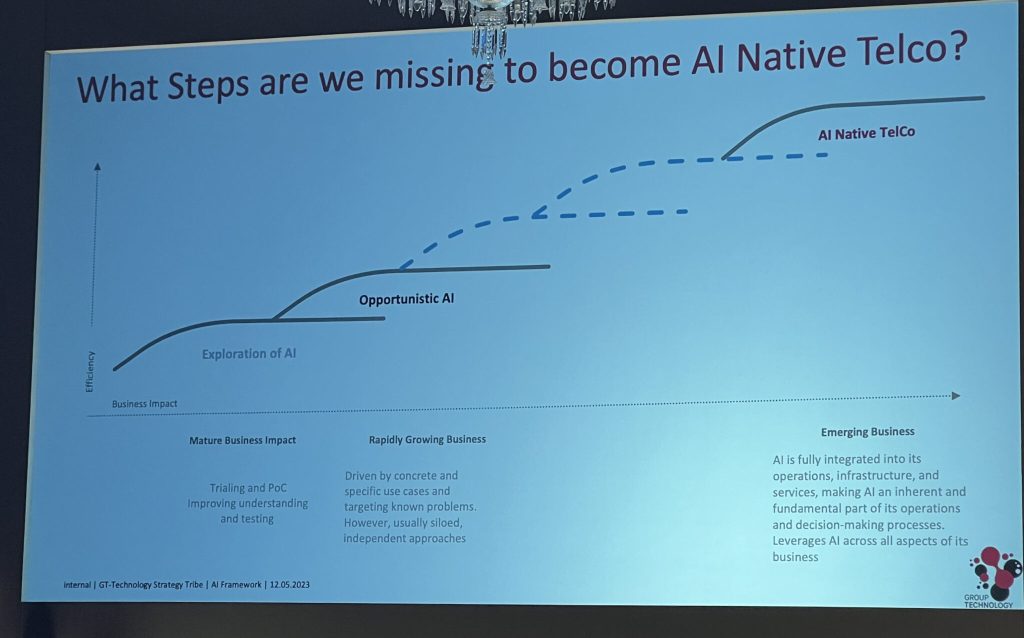

The AI-Native telco was co-hosted by Ahmed Hafez, VP Technical Strategy at Deutsche Telekom. The significance of AI is not only in its impact, but in the speed at which change will take place, especially in software development. Work that takes days today will be completed in minutes. Microsoft Copilot is already showing the power of the technology today.

Rakuten Symphony’s Geoff Hollingworth gets it: AI will become how we produce software. Juniper’s Neil McRae gets it: he brought along what will probably be the equivalent of the Altair 8800 in a new AI-centric era in software development, and called on telcos to equip their developers ASAP.

Panelists agreed that the idea of some sort of industry framework on AI was likely to be not only unnecessary but counter productive. They also agreed that the sort of AI project that aims only to automate what is being done today is missing the point. According to McRae, “the biggest barrier to telcos’ adoption of AI is the current mental model for how telecom works.”

But both data and domain knowledge are also essential. People who understand the business problem, and who know what the data means, are an integral part of the AI future.

Takeway: Whatever impact you think AI is going to have, it’s going to be way more and happen way faster. Now is the time to skill up.

Cloud-Native

We talked Cloud-Native too, of course. Arnaud Vamparys, CTIO of Orange, explained Orange’s plans to achieve Level 4 Autonomous Networks in 2025, with cloud-native networks fundamental to that effort.

Rakuten Symphony’s Parta Seetala demystified cloud-native by explaining that it is a software application design philosophy, not a technology. (I highly recommend catching that on the session replay). Heather Kinsey from the Linux Foundation has seen engagement with cloud-native evolve rapidly, with more telcos now setting out on the journey, not just thinking about it.

Takeaway: The future of telecom is not just software, it’s a cloud-native DNA.

Green Telco Summit

Neutral-host transport provider Connectivtree made the compelling analysis that the optimal sharing of the network would deliver the best energy usage outcomes. However, others like BT’s Howard Watson rejected the idea of sharing as a solution to energy management, perhaps reflecting another common thread in CSP presentations of the CSP as an end-to-end provider for everything.

Much of the immediate focus on energy seemed to be about better energy supply arrangements, followed by a focus on switching off legacy high-energy technology like PSTN/Copper networks and 3G. There was longer term focus at optimizing the operational efficiency of the network, though VMO2’s Head of Energy Optimisation Alex Depper noted that many of these business cases were now marginal with the fall in energy prices.

Appledore’s takeaway was that the focus of CSPs on energy is really on supply optimization and technology optimization, like new silicon. Commercial model change, be it disaggregation and sharing or demand management seemed to be off the table in most telco energy thinking. Panellists saw all usage and demand of the network as good usage. However, like in other industries, we probably need to realise the planet’s resources are limited. Just like in other sectors, we will have to probably ultimately account for the increased value of communication, not simply deliver an exponentially increasing volume of connectivity.

Standards

Standards were a recurring topic throughout the show with ETSI, NGMN present on stage. The CAMARA API/Open Gateway initiative was called out as an example of a new open approach to standards, that could counter the previous failure of telco APIs.

Software vendors Red Hat and Weaver Labs both emphasized that ultimately the success of an API is in its real-world usage, not its standardization. Telco clearly still finds it hard to just try things and put them out there for others to use (or not).

Heather Kirksey from the Linux Foundation called out that one of the fundamental challenges for telcos in taking the cloud opportunities is that the people in telco making decisions and standards rarely have a background in software. Much of the failure of NFV can be put down to this issue. With the emphasis of the first session on future staffing and skills needs of DSP as a techco, perhaps an increasing base of software skills within telcos will start to change this.

Separated by a Common Language

Innovation and words like cloud, AI, API, and transformation were on everyone’s lips at the show, though often used with little context as to what these really meant for the operator or its customers.

Partha Seetala from Rakuten Symphony made a key point in the session on cloud-native telco; cloud and cloud-native are very different concepts, but they get used almost interchangeably. Cloud is a way of delivering applications, typically tied to hyperscale public cloud principles. Cloud-Native is a way of building and operating applications that best leverage the cloud. Our industry’s lack of clarity on terminology often means that telco initiatives are vague about their outcomes and result in technical architecture “science projects”.

Customers?

Both BT’s Howard Watson and Juniper’s Neil McRae were clear that innovation in telecom must start with the customer: what is it that this technology/application/ecosystem is going to enable for our customers?

Appledore’s takeaway was that many of the programs presented by CSPs would benefit from clearer customer focus.

Overall

The event again lived up to its reputation as the “Davos of Telecom” with a good mix of discussion, real dialogue and the absence of PowerPoint (apart from one small eyechart from Deutsche Telekom)

The tools at telecom’s disposal have never been more amazing. Software-ization, cloud, approaches to standards (or not), new organizational and management thinking, AI, open interfaces are giving telecom the most incredible opportunity for change.

Yet that is not enough. To be a true “DSP Leader”, today’s telcos will have to demonstrate new characteristics. A willingness to experiment, to empower, to break organizational silos, and refuse to accept ‘No’ (or ‘Not yet’) for an answer to some of telecom’s most challenging questions. Now is exactly the right time to be “accelerating telecom innovation” – in every area of telecom.

Huge credit to the TelecomTV team (both in front of, and behind, the stage) who created an outstanding environment for presentation, discussion and networking, executed to perfection.

This blog is an edited extract from a longer research note and commentary available to Appledore subscribers.