Incremental revenue abounds – but only if telcos invest to automate, orchestrate and innovate.

The demands of enterprises are becoming more complex, as they look for ways to leverage new technologies (cloud, 5G, AI) in pursuit of growth and efficiency, while keeping on top of rapidly evolving security threats.

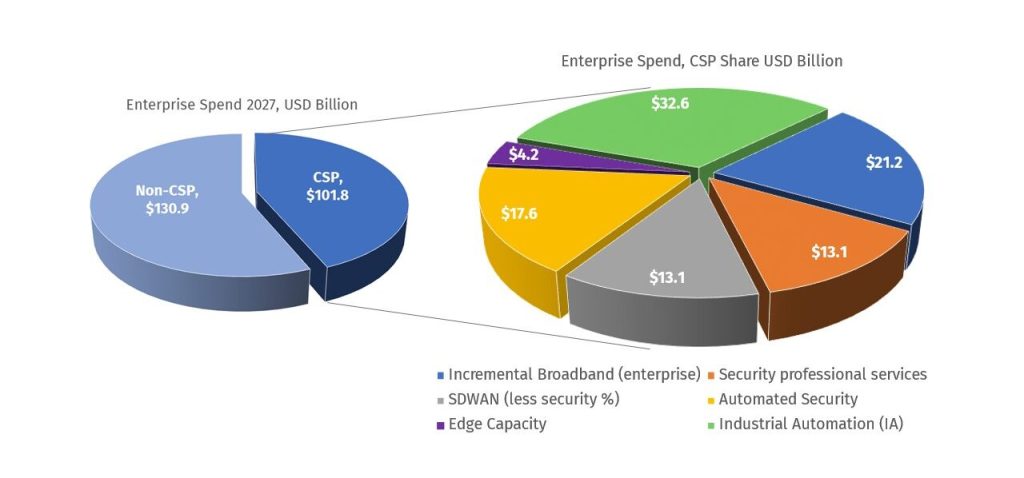

By 2027, Appledore forecasts that enterprises globally will be spending some $232bn annually on services and solutions in areas that today’s CSPs will have a role in supporting, such as SD-WAN, Security, and Industrial Automation.

We forecast that CSPs’ share of this incremental market opportunity will be just over $101bn.

Figure 1: Enterprise Spend Forecast on Telco-enabled Services, 2027, Appledore Research

Figure 1: Enterprise Spend Forecast on Telco-enabled Services, 2027, Appledore Research

However, capturing this business is conditional on CSPs making fundamental changes in their operational capabilities and mindset. The “enterprise opportunity” is not a single opportunity. Even within a given vertical, enterprises can have widely differing needs. For telecom to go from individual enterprise wins into wider market opportunities will require much greater ability to innovate, automate, and, in the era of cloud, orchestrate.

The economic lifecycle of consumer telecom services has just about run its course.

In the most developed, best-connected societies, consumer telecom is a commodity with little or no differentiation (certainly no lasting differentiation), and a declining return on investment despite consumers limitless desire for bandwidth.

In both fixed broadband and mobile, providers are essentially on a race to the bottom. Only those with the deepest pockets – or who achieve a sustainable breakthrough in unit economics – will survive. Hence, operators both fixed and mobile are pinning their hopes for growth on enterprises.

Telecom has a habit of deploying sophisticated network technologies, only to see other companies reap the benefits by creating new value on top of it. Yet in the case of the enterprise opportunity, it is telcos themselves who stand to monetize this new value; or at least to share a significant portion of it.

This incremental revenue is enabled by two fundamental changes to conventional telecom:

- By leveraging the economics of cloud to make otherwise complex and expensive offerings available (and affordable) to millions more customers.

- By enabling the rapid assembly of disparate (cloud-based) components, making innovation itself a much more scalable process – allowing many more niche needs to be served (the “long tail” beloved of internet companies).

For operators, achieving these requires a combination of innovation, automation and orchestration.

In a new analysis and forecast, Appledore sizes the incremental enterprise revenue opportunities that can be tapped by CSPs that make such investments, across six market segments, year-on-year from now through 2027:

- Industrial Automation (IA)

- Incremental Broadband (enterprise)

- SDWAN

- Automated Security

- Security Professional Services

- Edge Capacity

Appledore believes that today’s telecom operators can secure a unique position in supporting the growing needs of enterprises. The requisite capabilities are certainly available today, and the indicators are already there that having them leads to market success and incremental revenues.

Telecom operators can continue to compete, largely on price, on a commodity basis against rivals. They can continue to be anxious about the potential of hyperscale digital service providers to out-compete them on new enterprise revenues at the edge and in the cloud. Or they can regard a $100bn global opportunity as being worth the cost of investing in the new capabilities required to compete for it.

The window of opportunity will not stay open forever. In an increasingly internet timescales, both traditional and untraditional rivals are acquiring new skills and capabilities rapidly. Simply waiting is too high-risk as a strategy.

The report concludes with recommendations for CSPs and vendors in network automation and orchestration.

For further details including a table of contents and information on how to access the report, click here.

Image credit: Photo by Rahul Pabolu on Unsplash