Our major new market share report ranks leading vendors of telecom network automation software, and redraws the market landscape in the light of seismic changes.

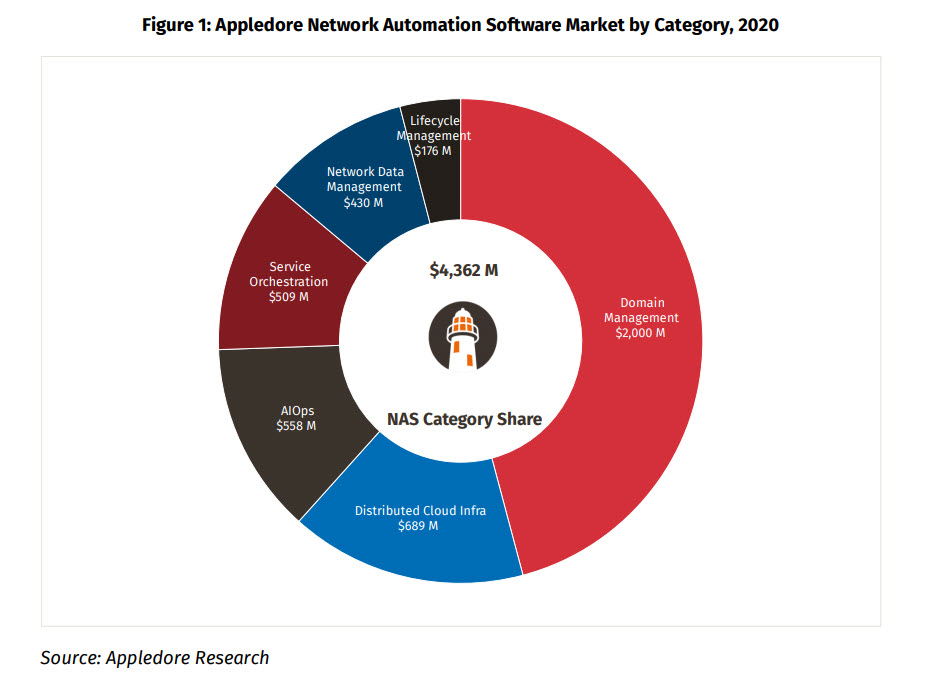

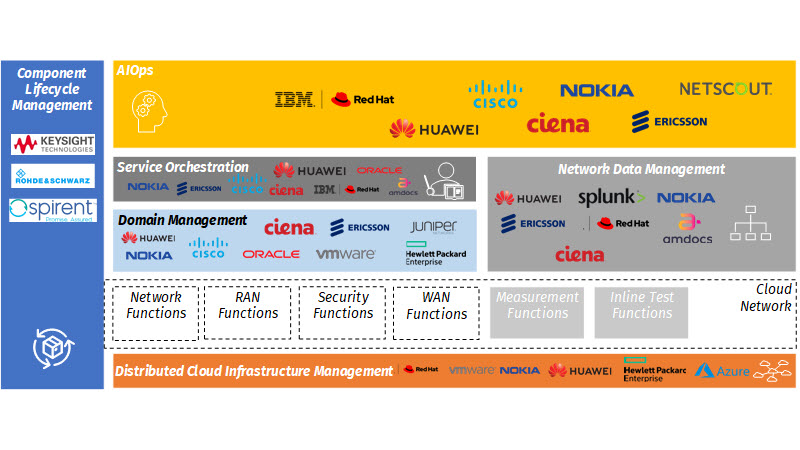

In 2020, CSPs spent $4.3B on software to automate their networks. Just less than half (49%) went to to major telecom equipment vendors such as Nokia, Huawei, Ericsson, Cisco and Ciena. But the other 51% was with pure play software vendors such as VMware, RedHat, Splunk and smaller vendors.

This represents a significant change of state in the network automation software (NAS) market, as we highlight in our latest report Leading Suppliers in Network Automation Software: A Market Transformed.

The modernization, digitization and cloudification of telecom networks over the last few years has not only resulted in a change to architectures and strategies. In our view, the telecom software market landscape itself has now been transformed. Traditional categorisations of “element management systems” (EMS), “network management systems” (NMS) and even “operations support systems” (OSS) no longer adequately reflect the context of telecom network automation software, nor the position of vendors in the market.

So, our new analysis redraws the NAS market landscape. It is a picture that reveals the true presence and potential of “new” players (that is, new to telecom) and re-locates established telecom network automation software vendors within a transformed set of future-ready market segments.

This new analysis provides a detailed market share breakdown of leading vendors in each of six categories:

- Artificial Intelligence Operations (“AIOps”) – the applications that use network (and other) data to drive decisions and processes.

- Service Orchestration – end-to-end control of network services and functions.

- Domain Management – largely, the classical “network-facing” functions.

- Distributed Cloud Infrastructure Management – software used to automate and optimize network inventory, place workloads.

- Network Data Management – collection, storage, presentation of network data of all kinds.

- Component Lifecycle Management (LCM) – software for automation of test, validation, onboarding and retirement of (software-ized) network functions.

We believe that automation is the dominant business driver behind new spend on software. However, network automation not just a category of spend but an operational philosophy that is materially different to conventional telecom operations approach. CSPs that fall further behind on this philosophy will naturally shift spend more slowly and realize fewer gains from their investments. We believe that, to succeed and thrive, CSPs must change metrics, incentives, organizational structures, and root out long held assumptions and prejudices that are no longer true.

The full report runs to over 35 pages, a free sample download is available. For more information see here.