Here’s the skinny: 5G will enable industrial automation, propel the next stage of world economic growth and productivity, improve standards of living, make industrial environments safer, and generate piles of money for NOKIA.

Economic Data Showing Significant Productivity Deviations between the “Best and the Rest”

Or that was the big theme of Nokia’s 2018 Global Analyst Forum, held at the storied Bell Labs facility in Murray Hill NJ. NOKIA put on an excellent two-day event with technical, commercial and industrial luminaries painting both the need and a solid overview of how NOKIA is building products and a business structure to deliver on those needs.

We were favorably impressed with NOKIA’s steady commercial progress, and with investments they are making in the fundamentals, both technical and business. Highlights include:

- Common Software Foundation: a major investment in modular, re-usable software functions using the open source model internally. Nokia claim 75% adoption of CSF

- A new enterprise business group – to further develop channels, partners and solutions for enterprise.

- Moving remaining “hardware independent” software (primarily IMS core) to the software business, concentrating the software business and reinforcing Nokia’s position that fixed and mobile access should share a common core.

- Order growth acceleration in the software business – Looking down the road from current revenues, Bhaskar Gorti noted 40% increase YoY in the order volume for his portfolio.

Nokia’s Common Software Foundation – Opensource Principles within Nokia

- Market share growth in IP/optical, combined with technology investments that promise to further open the performance lead they have today over competitors. The FP4 chip (see Appledore research note) is a superb chip enabling high performance routing with reasonable economics, and Sri Reddy indicated that it is allowing them to gain market share, as they look forward to FP5!

- 5G customer presentations and testimonials, including Telia,T-Mobile (USA) and AT&T (on a world-wide IoT network grid).

- Demonstration of what NOKIA call “FutureX” – and end-to-end NOKIA solution to high performance, virtualized, dynamic, AI-managed networks focused on industrial settings, but applicable to all. This environment is running live at Bell Labs, and utilizes Nokia’s current software and hardware product sets. They will unveil this environment in April 2019.

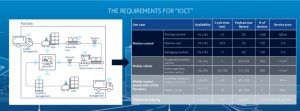

Returning to the 5G industrial IoT story line, NOKIA made a powerful case for how next-generation manufacturing, logistics, and pubic infrastructure all can benefit greatly from advanced communications technology. They also made a strong case for why they demand order-of-magnitude (sometimes two or three in fact) improvements in latency and reliability. I’m convinced- in many cases neither WIFI nor wires will cut it in precise, and flexible environments.

Requirements Matrix for Industrial IoT and Automated Manufacturing – A Huge Nokia Push

What became equally clear is that many of these networks, including the “edge” processing, will be private 5G networks, operated by industrial firms. Public networks have huge advantages where broad mobility is required and/or where networks and facilities can be widely shared, drastically lowering the effective cost. No firm, for example, can build out 50,000 cells across the US.

But the industrial cases showcased don’t have those characteristics. Robots and other sensors will live primarily within a factory or campus settings. Moreover, many of the prices control loops that are needed effect safety – both of robots (so they can’t injure nearby workers) or vehicles (so they don’t crash, or worse, crash into people). When life and death is at stake, it’s simply not realistic to assume that a low-latency, mission-critical processes will be trusted to a public wireless network – the risk is simply too high. Rather, in Appledore Research’s opinion, the lowest level of safety avoidance logic/loops will be built into the vehicle itself. In many industrial cases, external data is required, but that will likely be on site – for security, reliability, cost and performance reasons.

In other words, the opportunity for 5G sales, and edge computing, is first and foremost directly to enterprises. This is fine, since NOKIA is in fact tooling the sales force and partner ecosystem to do just this.To further facilitate that, NOKIA also introduced “Future X for Industries” at the event, which is an open framework for how enterprises across industries might look at evolving their infrastructure.

This leaves our primary question unanswered: “what will drive 5G deployment in public networks?” We have repeatedly (and rhetorically) asked for the economic driver for 5G. 4G LTE was easy: it was both much cheaper per unit capacity, and it delivered a vastly improved user experience, compared to 2G or 3G. Cheaper and better: done. But no one has given me a solid analysis that 5G is cheaper. Better, yes. Cheaper? – who knows? No one’s concretely saying.

Yet many discussions at the event provided a solid, if boring, answer: simple capacity. Demand on LTE networks continues to grow, and in many areas, networks are approaching their capacity limit. Subdividing cells is logical and straightforward, but there’s a catch: its slow – roughly two years to build a new physical site, and that’s way too long to wait for capacity. Rather, 5G will save the day, allaying vastly more capacity both in new spectrum, and in existing LTE spectrum – and we heard time after time “that’s the plan”. I get it. It’s boring but I get it. So 5G will also happen in the wide-RAN. And no one denies that its better – lower latency, faster, etc.

We thank Nokia for the investment and effort they put into this event, and for sharing their vision and actions with our community.

The Appledore Research team